In Why Are the Big Financial Institutions Selling Oil BIG?, Oilprice.com author Torkel Nyberg links oil and low-energy nuclear reactions (LENR) in his analysis of a recent Commitment of Traders (COT) reports.

It is a provocative thesis of his that the largest of corporations and financial institutions have inside knowledge of a breakthrough in LENR via Andrea Rossi‘s Ecat.

From the article:

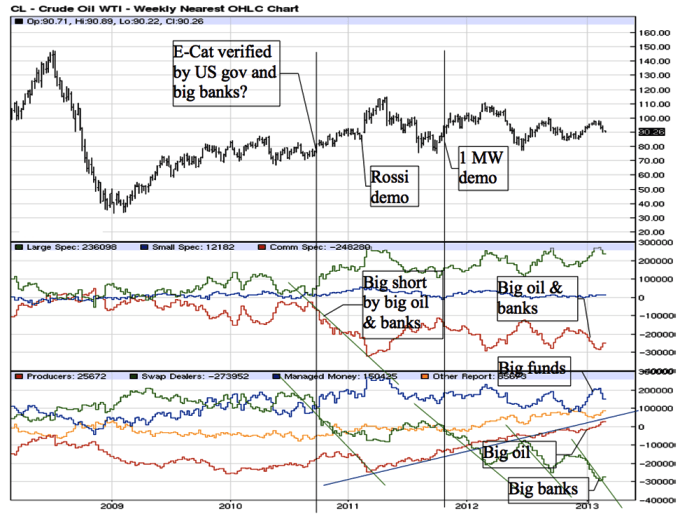

At some point during the fall of 2010 there was a large policy shift in hedging crude oil on the NYMEX futures exchange by the big banks and the oil companies. Up to that point the hedgers of crude have largely been the producers as they want to hedge their production against future price movements. On the buy side there was the big financial institutions (Swap Dealers = JP Morgan, Goldman Sachs, etc), and the money managers (large pension funds, hedge funds, etc.), that speculate in a price increase.

But during the fall of 2010 this state of affairs changed. From being net-long 200 thousand contracts, the banks became net-short in a couple of months. Their selling has since continued. And now, by March 2013, they are net-short 300 thousand contracts (300 million barrels of oil = $30 billion). See the green lines in the chart above.

At the same time the producers have liquidated their 200 thousand contract short position (blue line above). They are no longer hedging as they used to. And they’ve done it in a very consistent way. It looks almost unreal, buying an equal amount of contracts each month for two years.

During this time the banks have consistently been using a strategy to buy weakness and sell strength during their massive net-selling. As if their strategy was to build a huge short position and at the same time stabilize price. The conclusion is that the banks are now net-short about 300 thousand contracts at a price about $90-$95.

On the buy side the money managers went from being neutral by fall of 2010 to being net-long 250 thousand contracts as of today. This is of course the big funds, and in the end pensions and savings. They are now net-long oil and of course net-long all the producers (oil stocks).

Researching this strategy change has given very little information. One article though, from July 2012, touches on the subject. No answers and no explanations though. [Insidefutures.com]

Following the Commitments of Traders Report (CoT) does however reveal a great deal of information. The standard report shows the commercial traders, (oil companies and banks), large speculators (big funds) and smaller speculators (the rest). The disaggregated report also shows the position of banks and producers respectively. Both these reports are shown in the graph above. The combination does tell us that something is going on, but what?

Something real is going on, but what?

Continue reading here.

The realization of Peak Oil looms large in any examination of the oil business, and will figure in any industry moves.

But as incremental successes in experimental new energy cells from LENR accelerate, the potential Black Swan of cold fusion should not be far from any energy study either, and we are beginning to see that here.

This information confirms some of my long held suspicions. Without going into detail, which is too lengthy at this time, I will simply tell you this: Big oil and the financial powers on high have for some time seen the handwriting on the wall. The fossil fuel paradigm as we know it, is dead; it is simply awaiting burial.

The competition in the new world of energy is going to be fierce. There will be no place in this race for the lame — and that embodies all of the members of the fossil fuel paradigm. And that is as it should — and is long overdue.

Yeah, the smart money is shorting their positions on oil now, but the real market movement will occur when LENR becomes the next big thing as anointed by the mass media frenzy that will produce a positive feedback loop of coverage. Currently any energy technology as good as LENR is outside the ken of most people, including most of the financial and corporate world.

Yay!!

I have just cross posted this to Peakprosperity.com for them to put in their Daily Digest. I have been advised by Dr Martenson that Rossi’s claims were iffy, but I took the other side of the bet.

Let us see if the article is posted tomorrow.

If Not I will slot it into the Cold Fusion forum there.

As a matter of fact I wont wait. I’ll do it now.

Good spot Ruby.